Navigating The Landscape Of Artificial Jewelry GST Rates: A Comprehensive Guide

Navigating the Landscape of Artificial Jewelry GST Rates: A Comprehensive Guide

Related Articles: Navigating the Landscape of Artificial Jewelry GST Rates: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Artificial Jewelry GST Rates: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Artificial Jewelry GST Rates: A Comprehensive Guide

The world of artificial jewelry, with its dazzling array of colors, styles, and affordability, has captured the hearts of fashion enthusiasts worldwide. However, navigating the complexities of taxation, particularly the Goods and Services Tax (GST), can sometimes feel like navigating a maze. This comprehensive guide aims to demystify the intricacies of GST rates applied to artificial jewelry, providing clarity and insights for both consumers and businesses.

Understanding the GST Framework for Artificial Jewelry

The GST regime in India, introduced in 2017, seeks to simplify the indirect tax system and streamline the flow of goods and services. Artificial jewelry, broadly defined as imitation jewelry made from materials like plastic, glass, or metal alloys, falls under a specific category within the GST framework.

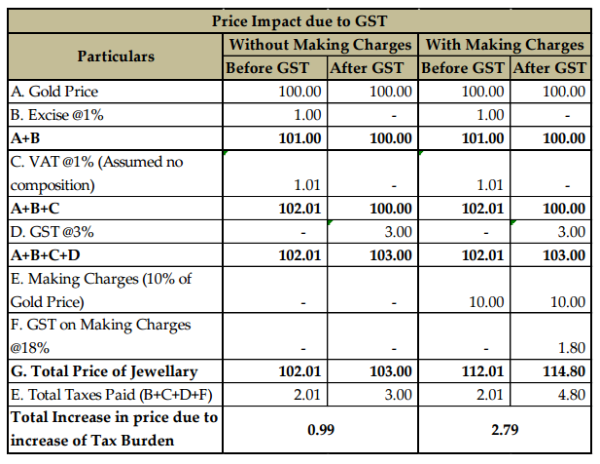

The GST Rate: A Crucial Factor

The GST rate applicable to artificial jewelry is a critical factor influencing its pricing and overall cost. Currently, artificial jewelry is classified under HSN Code 7117 and attracts a GST rate of 18%. This rate applies to all forms of artificial jewelry, including necklaces, earrings, bracelets, rings, and other decorative items.

Factors Influencing GST Rates on Artificial Jewelry

While the standard GST rate for artificial jewelry is 18%, several factors can influence the final cost:

- Material Composition: The material used in the creation of artificial jewelry can impact the GST rate. For instance, jewelry made from precious metals like gold or silver, even if imitation, may fall under a different category with a higher GST rate.

- Manufacturing Process: The manufacturing process, including the use of specialized techniques or intricate designs, can influence the GST rate.

- Place of Origin: The origin of the artificial jewelry can impact the GST rate, particularly if imported from other countries.

Importance of GST Rates for Artificial Jewelry

Understanding the GST rate for artificial jewelry is crucial for various stakeholders:

- Consumers: Consumers benefit from clarity on the final cost of artificial jewelry, enabling informed purchase decisions.

- Retailers: Retailers need to understand the GST rate to accurately price their products and maintain transparency in their operations.

- Manufacturers: Manufacturers must factor in the GST rate when calculating production costs and determining their selling price.

- Government: The GST levied on artificial jewelry contributes to the overall revenue collection, which is used for various public welfare programs.

Benefits of the GST System for Artificial Jewelry

The GST system offers several benefits for the artificial jewelry sector:

- Simplified Tax Structure: The GST system simplifies the tax structure, eliminating multiple taxes and creating a unified tax regime.

- Reduced Tax Burden: The GST system aims to reduce the overall tax burden on businesses, leading to potential cost savings.

- Improved Transparency: The GST system promotes transparency in the supply chain, making it easier to track the movement of goods and services.

- Enhanced Competitiveness: The GST system promotes fair competition within the artificial jewelry industry by ensuring a level playing field for all players.

FAQs on Artificial Jewelry GST Rate

Q1: What is the difference between artificial jewelry and imitation jewelry?

A: The terms "artificial jewelry" and "imitation jewelry" are often used interchangeably. However, a subtle distinction exists. Artificial jewelry refers to jewelry made from non-precious materials like plastic, glass, or metal alloys. Imitation jewelry, on the other hand, may use precious metals like gold or silver but with a lower karat value or plated with these metals to mimic the appearance of genuine jewelry.

Q2: Is GST applicable to all types of artificial jewelry?

A: Yes, the GST rate of 18% applies to all types of artificial jewelry, regardless of the material used or the complexity of the design.

Q3: How can I calculate the GST amount on artificial jewelry?

A: The GST amount is calculated as 18% of the price of the artificial jewelry. For example, if the price of a necklace is Rs. 1000, the GST amount would be Rs. 180 (18% of Rs. 1000).

Q4: Are there any exemptions from GST on artificial jewelry?

A: Currently, there are no specific exemptions from GST on artificial jewelry. However, certain categories of jewelry, such as jewelry made from precious metals with a high karat value, may fall under different GST categories with different rates.

Q5: What are the implications of GST on the price of artificial jewelry?

A: The GST rate directly impacts the final price of artificial jewelry. The 18% GST rate is factored into the retail price, leading to a higher cost for consumers.

Tips for Businesses Dealing with Artificial Jewelry GST

- Maintain Accurate Records: Businesses dealing with artificial jewelry should maintain accurate records of their purchases, sales, and GST payments.

- Understand the GST Compliance Requirements: Businesses need to comply with all GST regulations, including filing returns and paying taxes on time.

- Seek Professional Advice: If you have any doubts or questions about the GST rate for artificial jewelry, it is advisable to consult with a tax professional for expert guidance.

Conclusion

Understanding the GST rate for artificial jewelry is crucial for businesses and consumers alike. The 18% GST rate, applied consistently across the industry, ensures fairness and transparency. By navigating the intricacies of GST regulations and adhering to compliance requirements, businesses can contribute to a healthy and thriving artificial jewelry sector. This comprehensive guide provides a foundation for navigating the complexities of GST rates, empowering both businesses and consumers to make informed decisions within this vibrant and ever-evolving market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Artificial Jewelry GST Rates: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!