Navigating the World of Artificial Jewelry: A Guide to HSN Codes and GST Rates

Related Articles: Navigating the World of Artificial Jewelry: A Guide to HSN Codes and GST Rates

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the World of Artificial Jewelry: A Guide to HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Artificial Jewelry: A Guide to HSN Codes and GST Rates

The world of artificial jewelry, with its dazzling array of colors, styles, and materials, is a captivating realm. From delicate earrings to statement necklaces, artificial jewelry adds a touch of elegance and personality to any outfit. But navigating the complexities of this industry, particularly understanding the relevant HSN codes and GST rates, can be a daunting task for businesses and individuals alike. This comprehensive guide aims to shed light on these crucial aspects, providing clarity and insights for a smoother journey in the world of artificial jewelry.

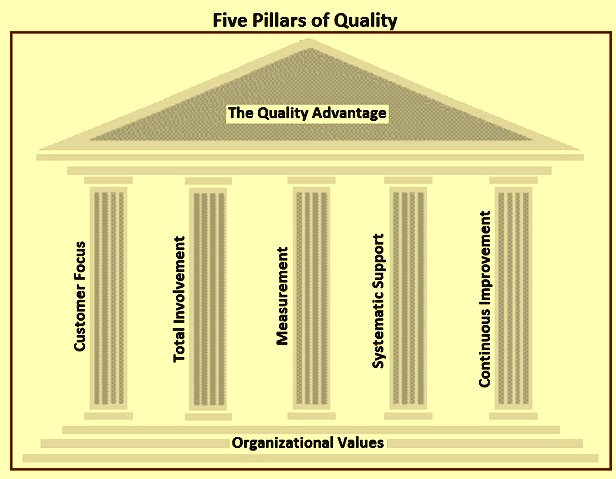

Understanding HSN Codes: A Foundation for Clarity

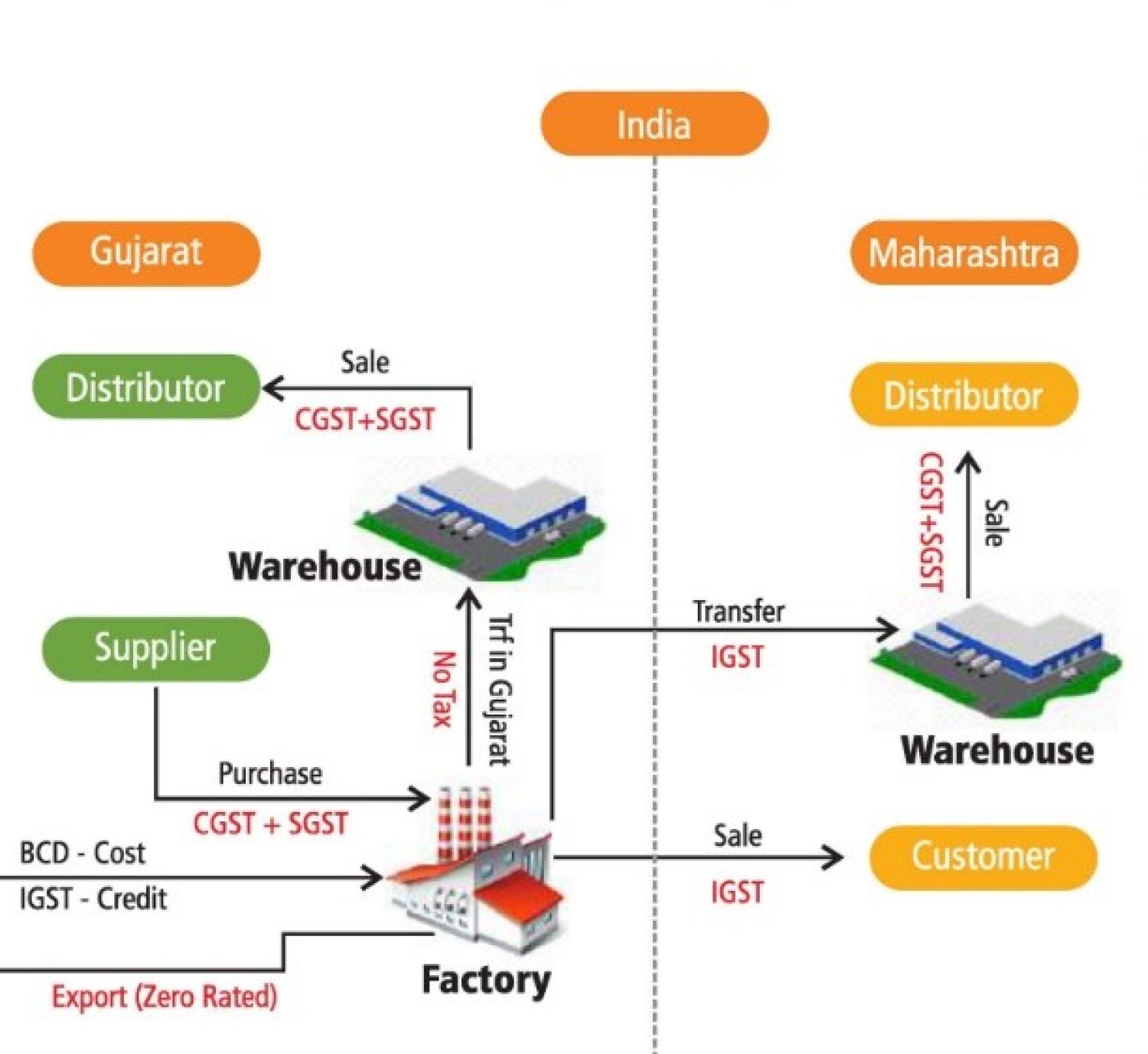

HSN (Harmonized System Nomenclature) codes are a globally recognized system used to classify traded goods. These six-digit codes provide a standardized language for describing products, facilitating international trade and simplifying customs procedures. For artificial jewelry, specific HSN codes are assigned based on the material used, the design, and the intended purpose.

Decoding the HSN Codes for Artificial Jewelry

The most common HSN codes for artificial jewelry fall under Chapter 71 of the Harmonized System, which encompasses "Pearls, precious and semi-precious stones, precious metals, metals clad with precious metal and articles thereof; imitation jewelry; coin."

Here’s a breakdown of the most relevant HSN codes:

- 7117.10: Imitation jewelry – This code encompasses a wide range of artificial jewelry, including those made from materials like glass, plastic, metal alloys, and other non-precious materials. This category typically includes items like earrings, necklaces, bracelets, rings, and pendants.

- 7117.90: Other imitation jewelry – This code encompasses items that don’t fit into the previous category. This could include items like artificial jewelry sets, costume jewelry, or jewelry specifically designed for theatrical performances.

- 7118.11: Articles of imitation jewelry, set with imitation stones – This code applies to artificial jewelry pieces that are adorned with imitation stones like rhinestones, cubic zirconia, or other non-precious stones.

- 7118.19: Articles of imitation jewelry, not set with imitation stones – This code applies to artificial jewelry pieces that are not adorned with imitation stones.

Navigating the GST Landscape: Understanding the Rates

Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services within India. The GST rate for artificial jewelry is currently 5%. This means that a 5% tax is levied on the sale of artificial jewelry, which is then passed on to the end consumer.

Factors Influencing GST Rate:

While the current GST rate for artificial jewelry is 5%, it’s important to note that the rate can vary depending on specific factors. For instance, the GST rate might be higher for artificial jewelry incorporating precious metals, gemstones, or other high-value materials.

Importance of Accurate HSN Code and GST Rate:

Understanding the correct HSN code and GST rate is crucial for businesses involved in the artificial jewelry industry for several reasons:

- Accurate Invoicing: Accurate HSN codes ensure that invoices are compliant with GST regulations, preventing potential penalties and legal complications.

- Tax Compliance: Correctly applying the GST rate ensures that businesses are paying the appropriate amount of tax and avoid potential penalties for non-compliance.

- Inventory Management: Using the right HSN codes can simplify inventory management and streamline business processes.

- Competitive Advantage: By accurately accounting for GST, businesses can set competitive prices and gain an advantage in the market.

FAQs: Addressing Common Questions

Q1. What are the GST rates for different types of artificial jewelry?

A1. The GST rate for most artificial jewelry is 5%. However, the rate might vary depending on the specific materials used. For instance, artificial jewelry incorporating precious metals or gemstones might attract a higher GST rate.

Q2. How do I determine the correct HSN code for my artificial jewelry?

A2. The HSN code for artificial jewelry depends on the materials used, the design, and the intended purpose. It’s recommended to consult the Harmonized System Nomenclature (HSN) manual or seek guidance from a tax expert for accurate classification.

Q3. What are the implications of using the wrong HSN code or GST rate?

A3. Using the wrong HSN code or GST rate can lead to several consequences, including:

- Incorrect Invoice: Invoices with incorrect HSN codes might not be accepted by authorities, leading to delays and potential penalties.

- Tax Non-Compliance: Using the wrong GST rate can result in underpayment or overpayment of taxes, leading to penalties and legal complications.

- Negative Impact on Business: Incorrect HSN codes and GST rates can create confusion, impact inventory management, and hinder business growth.

Tips for Navigating HSN Codes and GST Rates:

- Stay Updated: Keep abreast of any changes in GST rates or HSN code classifications through official government notifications and tax expert updates.

- Seek Professional Guidance: Consult a tax expert or chartered accountant for guidance on HSN code classification and GST rate application.

- Maintain Proper Documentation: Keep detailed records of HSN codes, GST rates, and invoices to ensure compliance and ease audits.

- Utilize Online Resources: Explore online resources like the GST website, tax portals, and industry associations for information and updates on HSN codes and GST rates.

Conclusion: Ensuring Compliance and Success

Understanding HSN codes and GST rates is fundamental for businesses and individuals operating in the artificial jewelry industry. By adhering to the guidelines, ensuring accurate classification, and staying updated on regulatory changes, businesses can navigate the complexities of tax compliance and position themselves for success in the competitive landscape. This comprehensive guide provides a foundation for navigating the world of artificial jewelry with clarity and confidence, allowing businesses to focus on their core strengths and contribute to the vibrant world of artificial jewelry.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Artificial Jewelry: A Guide to HSN Codes and GST Rates. We thank you for taking the time to read this article. See you in our next article!

.jpg)